Borough Department

Tax Collector

West Reading tax deadlines, payment methods, certification requests, contact info, sitting dates, and current borough, county, and business rates.

Borough and County Real Estate Taxes

Borough and County Real Estate Taxes are mailed by March 1st of each year. The discount period ends on April 30th and the flat period ends on June 30th. The penalty period is from July 1st to December 31st. By mid-January all delinquent tax bills are turned over to the Berks County Tax Claim Bureau.

Payment Methods

- Accepted: cash, check, money order

- Payable to: West Reading Borough Tax Collector

- No partial payments accepted

Tax Bill Questions

Deputy Tax Collector contact:

- Phone: (610) 374-8273 ext. 225

- Email: taxcollector@westreadingborough.org

- Available during business hours

In-Person Payments

- Location: Borough Hall

- Hours: 8:00 AM – 5:00 PM, Monday–Friday

- After-hours drop box: Borough parking lot

Pay By Mail

West Reading Tax Collector

500 Chestnut Street

West Reading, PA 19611

Include all required documentation.

West Reading Tax Guide

Instructions for paying Berks County court fines by mail, online, phone, or in person.

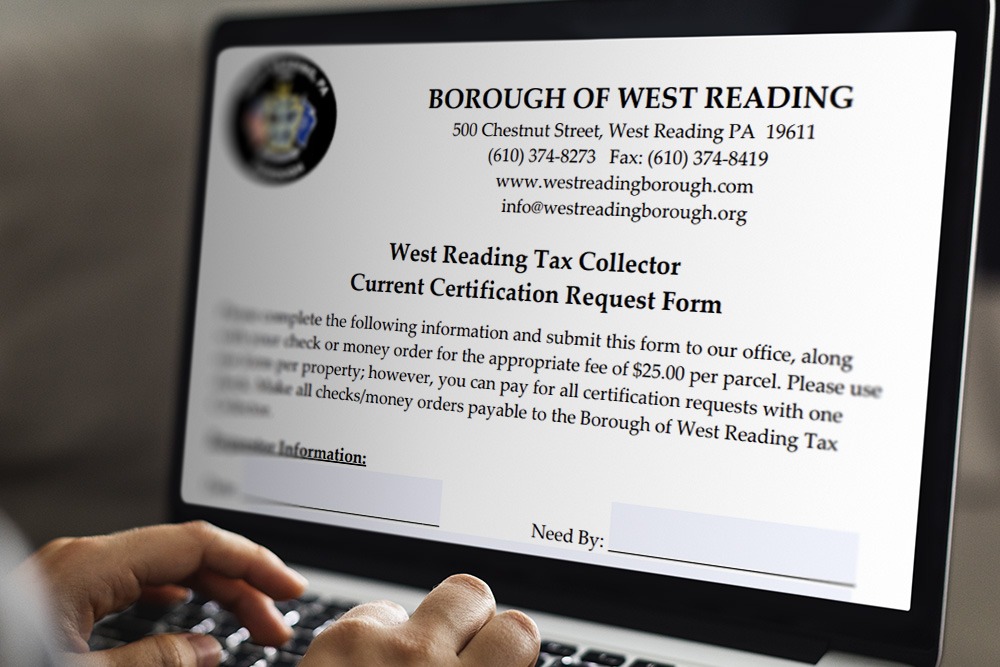

Certification Request

Borough of West Reading, Attn: Tax Collector, 500 Chestnut Street, West Reading, PA 19611

- Certification Request Form Note: Parcel numbers begin with 93 for West Reading Borough.

- For properties located outside of the borough, contact the collector for the municipality where the property is located. A list of tax collectors can be viewed here: Tax Collector List

- For prior years’ delinquent tax information, please contact the Tax Claim Bureau.

2025 Tax Collector Sitting Dates

Where: West Reading Borough Hall, 500 Chestnut Street, West Reading, PA 19611

Time: 3:30 – 5:00 p.m.

- Thursday, April 17

- Monday, April 21

- Wednesday, April 23

- Friday, April 25

- Tuesday, April 29

- Wednesday, April 30

Borough Tax Rates

- Real Estate Tax – 9.75 mills

- Fire Protection Tax – 2.85 mills

- Infrastructure Tax – 1.00 mills

- Berks County Real Estate Tax – 9.013 mills

- Wyomissing Area School District Tax – The Wyomissing Area School District real estate and per capita taxes are established by the school board. Payments are not accepted at Borough Hall. To obtain further information please contact the tax clerk at 610-374-0739 ext. 1101, email taxes@wyoarea.org.

- Local Services Tax – $52 annually, payable to Berks County Earned Income Tax Bureau (Berks EIT).

- Business Privilege License – $50 annually, please contact Berkheimer Tax Innovations at 610-599-3140 or email BPT@hab-inc.com.

- Business Privilege and/or Mercantile Tax – Please provide a questionnaire to Berkheimer Tax Innovations for processing. Should you have any questions, please contact Berkheimer Tax Innovations through the channels listed above.

West Reading Borough has not collected a Per Capita Tax since 2002.

| Key Contact | Phone |

|---|---|

| Cynthia Madeira | 610-374-8273 Ext. 222 |

Frequently Asked Questions

What is the maximum real estate tax rate?

The maximum rate, according to Section 1302 (a) of the Borough Code, is 30 mills. However, the borough can levy an additional five mills, through court order, for specific purposes, such as purchasing fire equipment, paying interest on debt, or caring for shade trees.

I don’t agree with the assessed market value of my property. Who can I call?

Berks County Assessment Office (610) 478-6262 or Email: assessment@countyofberks.com